Diversity in UK

Venture Capital 2019

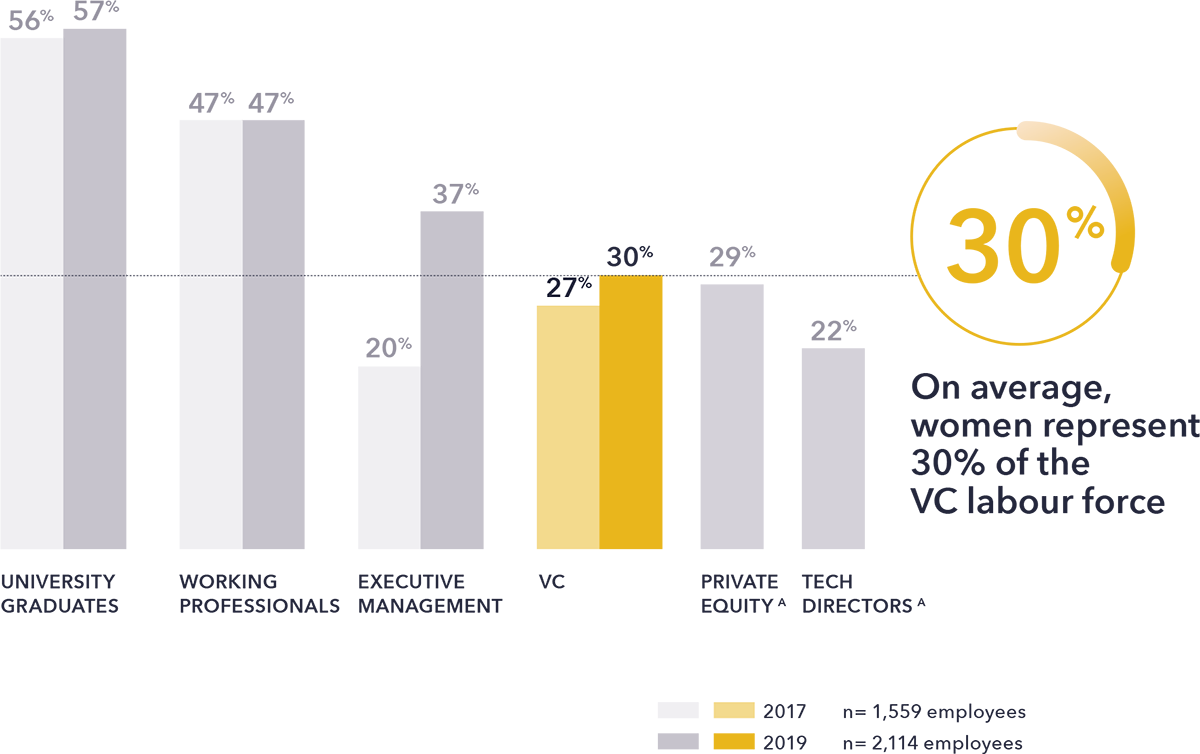

The representation of women in venture is increasing

We surveyed 171 active venture capital firms in the UK. Over 80% are independent venture capital firms. Nearly 20% are corporate venture vehicles, accelerators with a dedicated fund or family offces (the majority of accelerators and incubators were excluded from our analysis). Based on a sample of firms surveyed, 80% typically write cheques of £10m or less. The majority of firms make investments in the technology sector.

In our previous survey (Diversity VC, 2017), we collected data regarding gender diversity in the venture capital community. In our latest analysis, we surveyed a broader set of metrics – relating to ethnicity, education and career history – to provide greater insight into the UK’s venture capital workforce.The scope of our study

Using publicly available data we prepared a list of employees, and associated data, for each firm. In total we reviewed: 2,114 employees; 2,920 education records; 12,153 previous employment roles; and 307 responses to a survey regarding ethnicity.

108 of the firms previously provided data for our 2017 study and form the basis of our comparative analysis.Key Findings

Report outcomes

The representation of women in venture is increasing

In 2019 women comprise 30% of venture capital personnel – a small increase from 27% in 2017.

While the trajectory is positive and implies better representation than in the Private Equity industry and among Technology Directors, female representation in venture capital still lags behind the average of UK working professionals.

Note A: It was not possible to align those that were schooled in overseas institutions with the ranking of British institution.

Note B: All fgures for the UK average are based upon the UK’s working age population, apart from the figures for Oxbridge which are calculated for current 18 year olds.

General Note: Percentages are not additive, as individuals may hold more than one degree, and would be double counted.

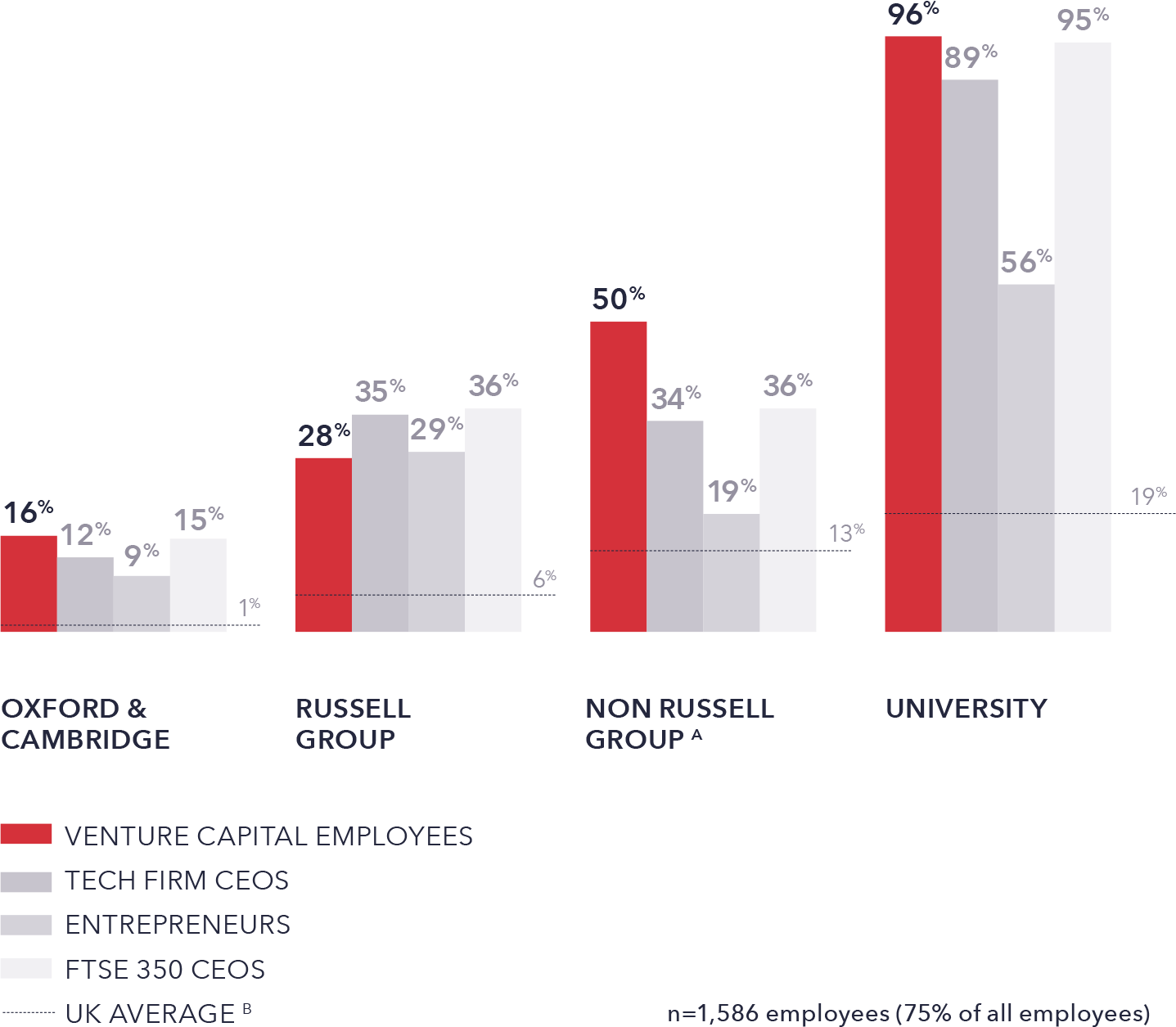

Sources: Sut ton Trust, Elitist Britain (2019); Diversity VC analysis (2019).Venture capitalists typically have extensive education

Personnel in the venture capital industry exceed national averages for education across all metrics. 96% of venture capital professionals have a university education. 28% attended a Russell Group university.

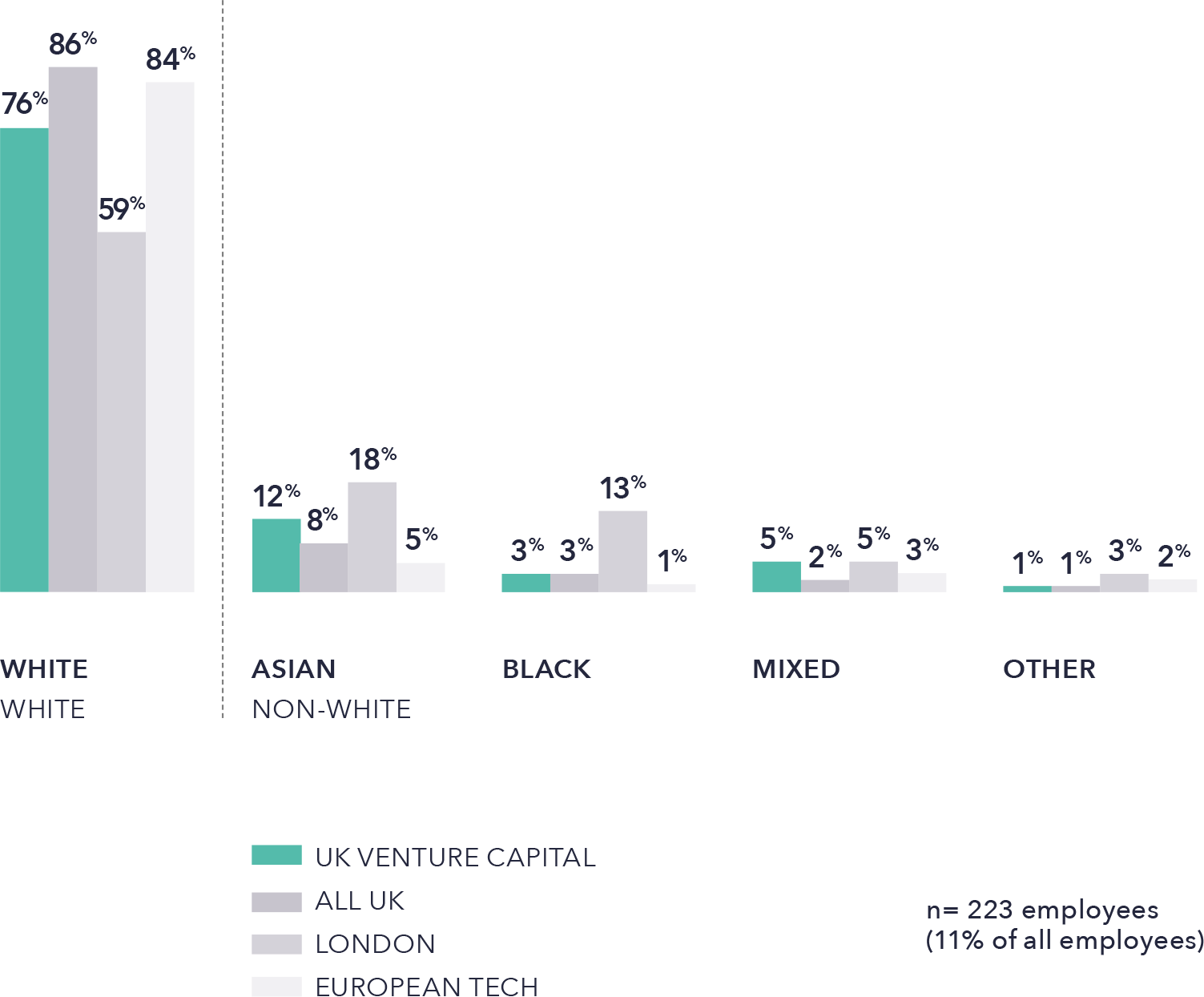

13% studied at Oxford or Cambridge. Against comparable industries, venture capital professionals have a broadly similar educational profle, with little difference in educational attainment among venture capitalists, technology CEOs and FTSE 350 CEOs.Ethnic minorities are likely under-represented in venture capital

An ethnicity survey of 223 UK venture capitalists suggests that 24% of the venture workforce is non-white. This sample has not been adjusted for selection bias.

Many of the firms surveyed are located in London, one of the most ethnically diverse regions in England and Wales where over 40% of residents identify as Asian, Black, Mixed race or Other ethnic group.

When compared with the London average, ethnic minorities are under-represented in venture capital.

General note: In this research, par ticipants were given the option to par ticipate, and their decision to respond (or not) may be correlated with traits that affect the results. It was not possible to adjust our fndings to account for ‘self-selec tion bias’ and the results may not be wholly representative of general industry trends.

General Notes: Percentages are subjec t to rounding. Data are collec ted and classifed using a standard set of UK ethnic groups, following the methodology set-out by the UK Census (2011). A full methodology can be found in the appendix.

Sources: UK Census (2011); Diversity VC analysis (2019); Atomico, State of European Tech (2018)Representation of women in venture capital is improving...

Over the last two years, the percentage of women venture capitalists has increased. There has been significant improvement regarding representation in junior-level roles.

In society at large, there is growing awareness for gender equality. In UK venture capital there are a number of targeted initiatives to promote gender balance including:

- The British Venture Capital Association’s (BVCA) ‘Women in Private Equity & Venture Capital’ breakfasts;

- HM Treasury’s ‘Women in Finance Charter’, to which many venture capital firms have committed; and

- ‘Women in VC’ dinners and the ‘Future VC’ programme coordinated by Diversity VC.

...but women remain under-represented at senior levels.

The percentage of women in senior investment roles has not changed. 83% of frms have no women on their investment committees.

There is a signifcant drop in the percentage of women working in venture capital that have fve or more years of experience. Further work is needed to understand the causes behind this trend, and to prepare positive solutions to increasing representation the highest levels of the industry. Future studies also need to consider expanded defnitions of gender.

As previously noted, there has been a recent increase in the number of women hired at junior- and mid-levels of seniority, suggesting that the representation of women at a senior level may improve in future.DOWNLOAD THE FULL REPORT

Diversity in UK Venture Capital 2019